Introduction

In today’s financial landscape, cash loans have become one of the fastest-growing borrowing solutions. Whether it’s paying emergency medical bills, clearing utilities, or managing unexpected expenses, people increasingly rely on cash loans from direct lenders only, cash loans online with direct deposit, and even cash loans without direct deposit.

Unlike traditional bank loans, which demand paperwork, credit checks, and long approval times, these loans prioritize speed, accessibility, and flexibility. Borrowers can apply online, get approval in minutes, and receive funds either through direct deposit or, in some cases, in cash or prepaid card form.

This article explores the history, pros and cons, facts and figures, and the future outlook of the cash loan industry. We’ll also compare options like cash loans direct lenders only, cash loans no direct deposit required, and cash loans online direct deposit to help borrowers make informed choices.

What Are Cash Loans from Direct Lenders Only?

A cash loan from direct lenders only means the loan is processed directly by the lender without brokers or third-party agents. This system benefits borrowers in several ways:

- Faster approvals since applications don’t pass through multiple channels.

- Lower costs because no middleman fees are involved.

- Transparency – the borrower deals directly with the lender.

- Better repayment negotiation – lenders may offer extensions or flexible terms directly.

This has become particularly important as many borrowers want security and clarity about who they’re borrowing from.

Cash Loans Online Direct Deposit

The most popular modern form of borrowing is cash loans online direct deposit, where the approved loan amount is sent directly into the borrower’s bank account. This eliminates the need for physical cash pickups or paper checks.

Benefits include:

- Instant transfers (some lenders offer same-day or even within 30 minutes).

- Secure and trackable payments via bank systems.

- Convenience – funds are available anytime, even at night or weekends.

This option is widely used in the U.S., UK, Canada, and Australia, where online payday and installment loan lenders dominate the short-term credit market.

Cash Loans Without Direct Deposit

Not everyone has or wants to use a bank account. For such borrowers, cash loans without direct deposit are an alternative. These loans can be disbursed through:

- Cash pickups at store locations.

- Prepaid debit cards.

- Money transfer services (e.g., Western Union).

While less common today, they still serve unbanked populations, which, according to the Federal Deposit Insurance Corporation (FDIC), include around 4.5% of U.S. households (about 6 million people).

Past: The Evolution of Cash Loans

Traditionally, people relied on banks, credit unions, pawnshops, or even borrowing from friends and family. Payday lending began expanding in the 1980s and 1990s as storefront cash loan shops became common across America.

At that time:

- Borrowers physically visited a lender’s office.

- They provided a post-dated check or signed authorization.

- Funds were disbursed as cash or paper checks.

There were no apps, no direct deposits, and no instant online approvals. The process was simple but time-consuming.

Present: Digitalization of Cash Loans

The rise of fintech and mobile technology has transformed the loan industry. Today’s borrowers can choose:

- Cash Loans Direct Lenders Only – Apply directly on lender websites/apps.

- Cash Loans Online Direct Deposit – Receive money in the bank within hours.

- Cash Loans Without Direct Deposit – Get prepaid cards or in-person pickups.

This digital revolution has made loans accessible 24/7, across borders, and with minimal paperwork. However, it has also created concerns about high-interest rates and consumer debt cycles.

Pros of Cash Loans

- Fast approval – Many lenders approve within minutes.

- No credit barriers – Even bad credit applicants may qualify.

- Flexible payout methods – Options with or without direct deposit.

- Direct lender transparency – No brokers, no hidden application selling.

- Emergency-friendly – Perfect for urgent financial needs.

Cons of Cash Loans

- High-interest rates – APRs can range from 200% to over 600%.

- Short repayment terms – Usually 2–4 weeks for payday loans.

- Debt trap risk – Many borrowers roll over loans repeatedly.

- Limited amounts – Often $100–$1,500, not ideal for large expenses.

- Hidden fees – Late charges and processing fees may apply.

Facts and Figures

- In the U.S. payday lending industry, borrowers take out about 12 million loans annually.

- Average loan size: $375–$500.

- Average repayment period: 14 days.

- About 80% of loans are rolled over or followed by another loan, creating cycles of debt.

- Direct lender loans make up over 60% of the online short-term loan market.

(Source: Consumer Financial Protection Bureau, FDIC, Pew Research)

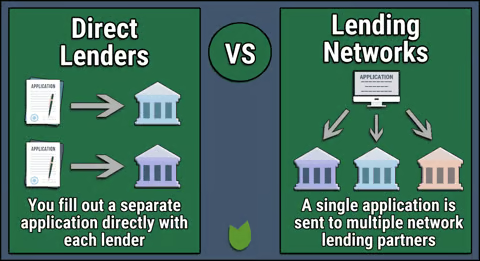

Cash Loans Online Direct Lenders vs. Brokers

- Direct lenders: Deal directly with borrowers, approve loans, and collect repayments.

- Brokers: Collect applications and sell them to lenders, often charging extra fees.

For borrowers, direct lenders are safer and more transparent since they know exactly who they’re dealing with.

Future: What’s Next for Cash Loans?

The future of cash loans will be shaped by regulation, technology, and consumer demand.

Key Trends:

- AI-based credit checks – Using AI to assess repayment ability without relying only on credit scores.

- More flexible repayment – Shift toward installment options instead of short-term lump-sum repayment.

- Blockchain and digital wallets – Faster, borderless loan disbursements.

- Stronger regulations – Governments worldwide pushing to cap interest rates.

- Expansion in developing countries – More focus on unbanked populations in Africa, Asia, and Latin America.

Alternatives to Cash Loans

Before opting for cash loans with or without direct deposit, borrowers should explore safer alternatives:

- Credit union small-dollar loans – APRs usually below 28%.

- Employer salary advances – Increasingly offered by companies as a benefit.

- Personal installment loans – Longer terms, lower interest.

- Credit cards – Often cheaper than payday loans if paid on time.

Case Study: Borrower Experience

- Scenario 1 – Direct Deposit Loan: A borrower downloads a lender app, applies at midnight, and gets $300 direct deposited into their account within 30 minutes.

- Scenario 2 – Loan Without Direct Deposit: Another borrower without a bank account applies online and gets $200 on a prepaid debit card the next morning.

Both benefit from the speed, but their repayment terms remain strict.

Reviews and Customer Sentiment

Customer reviews show mixed experiences:

- Positive: “Cash loans direct lenders only helped me avoid extra broker fees and gave me money in under 20 minutes.”

- Negative: “The interest rate was 400%, and I had to borrow again to repay the first loan.”

These highlight the importance of reading reviews and understanding loan terms before committing.

Conclusion

The world of cash loans has dramatically evolved from storefront payday shops to direct lenders online offering cash loans with or without direct deposit.

- Direct lenders only loans ensure transparency and faster approvals.

- Cash loans online direct deposit remain the most popular for instant funding.

- Cash loans without direct deposit serve those without bank accounts.

While these loans provide quick relief in emergencies, they come with high-interest rates and repayment risks. Borrowers must carefully weigh the pros and cons, read reviews, and consider alternatives before applying.

Looking ahead, the industry will likely become more tech-driven, regulated, and borrower-friendly, but responsible usage will remain the key to financial stability.